Written by Digital Euro Association | Mar 31, 2022 6:30:00 AM

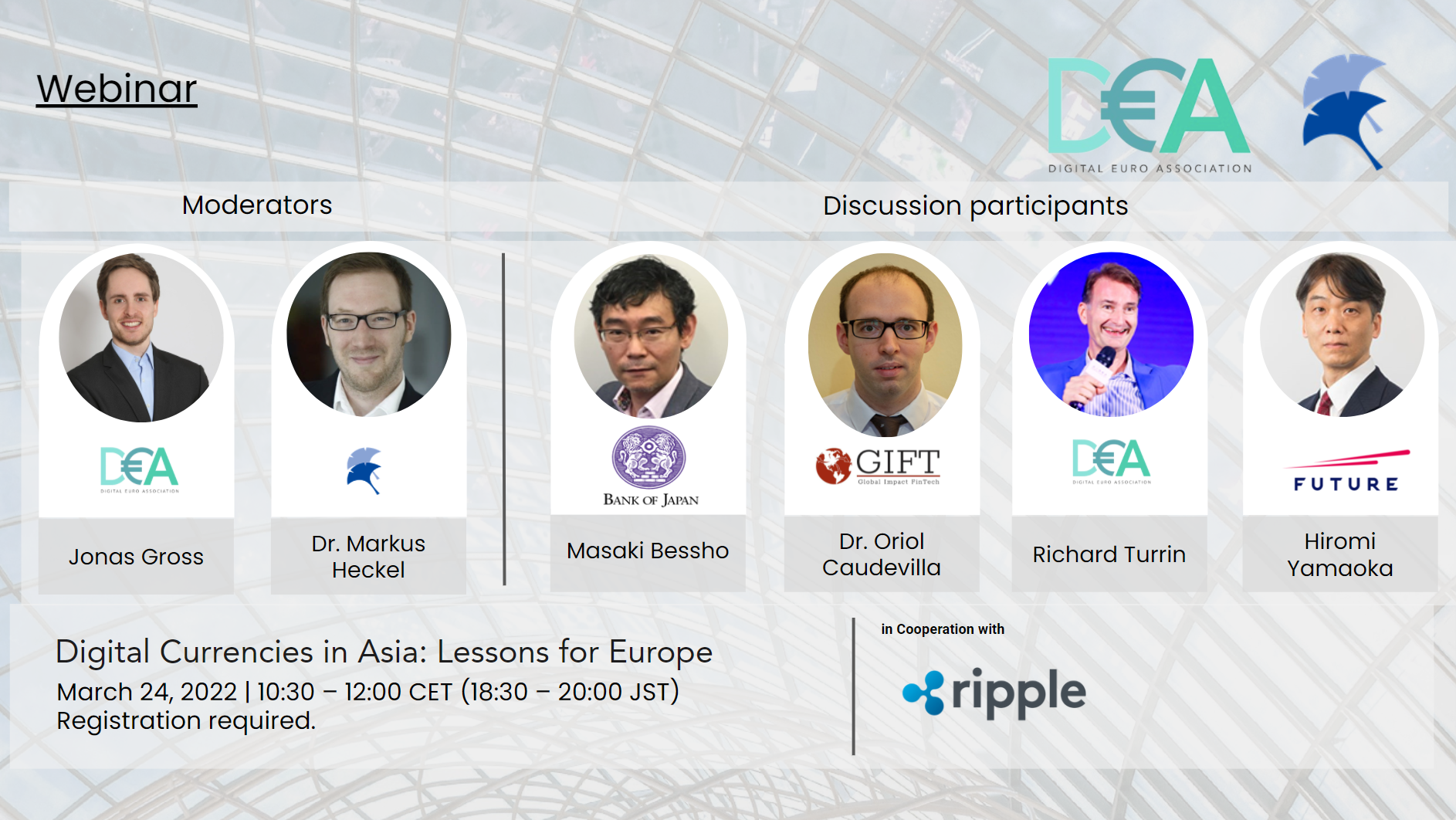

Central banks around the world have stepped in and intensified their efforts to conceptualize and design their own digital currencies, i.e., central bank digital currencies (CBDCs), in particular, as a reaction to the increased competitive dynamics by the cryptocurrencies and stablecoins. Asia has a particular importance and critical leading efforts in this space with various Asian central banks assessing and experimenting with CBDCs. In this panel, Masaki Bessho, Dr. Oriol Caudevilla, Richard Turrin, Hiromi Yamaoka and the moderators Jonas Gross and Dr. Markus Heckel elaborate on what Europe can learn from these efforts.

Watch this panel on YouTube (ca. 88 min.)