Share this

Who Needs an e-Yuan?

by Christian Pfister and Nicolas de Seze on Dec 1, 2023 10:45:55 AM

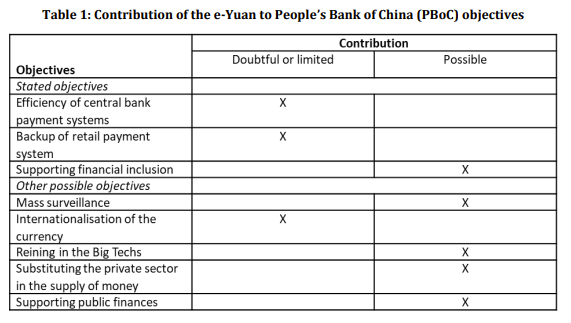

China could be the first major economy to issue a CBDC. We first provide an historical overview of this project, putting it in political perspective, then present its main features. We recall the strategic objectives put forward by the People’s Bank of China (PBoC) for the e-Yuan, discuss them and ask whether other objectives may not matter more. We conclude that the e-Yuan could be particularly useful for the Chinese government.

1. Historical overview and political perspective

The PBoC claims a pioneering role in the work on CBDC, which it started as early as 2014. To put this work in a political perspective, the PBoC states that “Since the 19th National Congress of the Communist Party of China, following the guidance of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, the PBoC

has made solid efforts to advance the pilot program of e-Yuan research and development. Adhering to marketbased and law-oriented principles while staying committed to people’s interest, the PBoC has advanced the development of e-Yuan in line with China’s conditions through three stages: theoretical research, closed-loop

testing, and pilot application” (PBoC, 2022).

In 2016, the PBoC established the Digital Currency Institute and proposed the top-level designs and fundamental features of e-Yuan (PBoC, 2021). At the end of 2019, the PBoC started pilot tests in four cities. Later on, pilot areas were progressively expanded to cover 23 cities. In order to favor the adoption of the e-Yuan during these pilot tests, many promotional campaigns were organised in the pilot areas, in particular with giveaways. An important milestone was reached in January 2022, in the run-up of the Beijing Winter Olympics, with the availability of the «e-Yuan pilot version» on Android and Apple, and shortly after on WeChatPay and Alipay. In the meantime, use cases were progressively expanded, for example to the payment of public transportations, taxes, medical care, public aids, etc.

As explained by Changchun Mu, Director General of the PBoC’s Digital Currency Institute (BIS, 2023) although the e-Yuan will be legal tender, its use by citizens cannot be made mandatory, hence the need to make the e-Yuan more appealing and user-friendly. That is why, since the launch of the e-Yuan pilot version early 2022, the PBoC

has released numerous versions of its App. At the time of writing this article (October 2023), the e-Yuan was still in the pilot stage and no decision had been announced regarding a timetable for a possible “go live” of the e-Yuan. But the stance of the PBoC is clear: “The train has left the station. The PBoC believes that CBDCs will be the answer for the digital era” (Mu, 2022b).

2. Current situation

2.1 Some figures

According to the PBoC, at the end of June 2023, the pilot areas had (cumulatively) recorded 950 million e-Yuan transactions for a total value of RMB 1.8 trillion ($ 250 billion), with 120 million wallets being opened. These figures may look substantial but the total amounts held in e-Yuan still represent a small proportion of the monetary aggregates: e-Yuan, which was included in M0 from December 2022, accounted for only 0.16 % of it at end-June 2023 (PBoC, 2023).

2.2 Main features

If it is officially launched, the e-Yuan would share many features with other CBDC projects: it would be a central bank’s liability to the public, with legal tender, settlement upon payment, non-remuneration and no collection of fees. Also, the e-Yuan would be based on a two-tiered architecture whereby the PBoC issues the e-Yuan to authorized operators, and authorized operators distribute the e-Yuan to end users. The e-Yuan would have a dual off-line payment function allowing payments to be made between two phones or two cards. To a certain extent more originally, the PBoC has adopted the so-called “loosely-coupled account linkage design” which means that users could apply for e-Yuan wallets without opening a bank account (Mu, 2022b). According to the concept of “managed anonymity (see below), different categories of wallets could be opened, with different KYC levels. For instance, wallets of the lowest category (category 4) could be opened with only a mobile phone number, but with relatively low amount limits: 2 000 yuans ($ 280) per transaction, 5 000 yuans per day and a maximum balance of 10 000 yuans. Users could upgrade their wallets to an upper category by providing more

KYC information such as ID or bank account information (Mu, 2022a).

2.3 Cross-border use

Although the e-Yuan is so far designed for domestic retail payments, the PBoC states it will “actively respond to initiatives of the G20 and other international organisations to improve cross-border payments, and explore the applicability of CBDC in cross-border scenarios” (BIS, 2022). Referring to the concerns that a cross-border use of the e-Yuan might raise, the PBoC has introduced three principles that “shall be observed before conducting any CBDC cross-border experiments” (Mu, 2022b):

- No disruption: CBDCs supplied by one central bank should not disrupt other central banks’ currency sovereignty and their ability to fulfill their mandate for monetary and financial stability.

- Compliance: cross-border payment arrangements with CBDCs should comply with the regulations of the jurisdictions concerned.

- Interoperability: the development of CBDCs should enable interoperability between CBDC systems of different jurisdictions as well as between CBDC systems and incumbent payment systems.

3. Strategic objectives the PBoC puts forward

The PBoC has put forward three strategic objectives (Mu, 2022b).

3.1 Improving the efficiency of central bank payment systems

However, the Chinese private retail payment system is already very efficient, in fact more efficient than in many developed economies. In particular, QR-code real-time payments, accessible on a 24/7 basis, including offline, have been available in most parts of the country since 2015, through the networks of Alipay and TenPay.

3.2 Providing a backup or redundancy to the retail payment system

The PBoC argues that AliPay and TenPay have become important retail payment infrastructures, so that any failure, be it of a financial or technical nature, will dramatically impact payment system operation, and even introduce systemic risks. However, the appropriate response to this oligopoly situation would rather seem to be

to introduce more competition in the payment services industry.

3.3 Supporting financial inclusion and equal access to digital payment

These are probably more valid motives, since the PBoC indicates that between 10% and 20% of the population are unbanked or underserved. However, there are other ways than launching a CBDC to support financial inclusion and equal access to digital payment, as the example of M-Pesa in Kenya has shown. All in all, none of the three above-mentioned strategic objectives put forward by the PBoC seems fully compelling

Read the full publication here.

This article was prepared by the author/s. The views expressed in this article are the author’s own and do not necessarily reflect the views of the Digital Euro Association.

Share this

- CBDC (44)

- Events (27)

- Partnership (27)

- Stablecoins (25)

- Digital euro (24)

- Quarterly Insights (8)

- ECB (7)

- Privacy (4)

- Thesis Awards (4)

- Article series (3)

- Central bank digital currencies (3)

- Crypto (3)

- Jobs (3)

- Law, regulation & policy (3)

- Tokenized Deposits (3)

- digital yuan (3)

- Academics (2)

- DEC23 (2)

- DEC25 (2)

- Digital Money (2)

- Members Assembly (2)

- MiCA (2)

- Public Hearing (2)

- Regulation (2)

- Sand Dollar (2)

- e-CNY (2)

- monetarypolicy (2)

- Adoption (1)

- Ai (1)

- Blockchain (1)

- Central Banking (1)

- Cross-Border (1)

- DEC24 (1)

- Diem (1)

- Digital Euro Association (1)

- Digital Pound (1)

- Digital Pound Foundation (1)

- Education (1)

- Eurocoin (1)

- Facebook Pay (1)

- FinTech (1)

- Geopolitics (1)

- Novi (1)

- Offline (1)

- Petition (1)

- Project Hamilton (1)

- Public Affairs (1)

- Quantum (1)

- Ripple (1)

- Technology & IT (1)

- USA (1)

- investors (1)

- June 2025 (1)

- May 2025 (4)

- April 2025 (5)

- January 2025 (1)

- December 2024 (3)

- November 2024 (3)

- October 2024 (4)

- September 2024 (2)

- August 2024 (3)

- July 2024 (6)

- June 2024 (1)

- May 2024 (4)

- April 2024 (4)

- March 2024 (4)

- February 2024 (4)

- January 2024 (2)

- December 2023 (3)

- November 2023 (2)

- October 2023 (3)

- September 2023 (5)

- August 2023 (5)

- July 2023 (9)

- June 2023 (5)

- May 2023 (3)

- April 2023 (2)

- March 2023 (7)

- February 2023 (3)

- January 2023 (3)

- November 2022 (2)

- October 2022 (4)

- September 2022 (8)

- August 2022 (11)

- July 2022 (4)

- June 2022 (5)

- May 2022 (3)

- April 2022 (6)

- March 2022 (8)

- February 2022 (6)

- January 2022 (1)

- December 2021 (1)

- November 2021 (1)

- October 2021 (1)

No Comments Yet

Let us know what you think