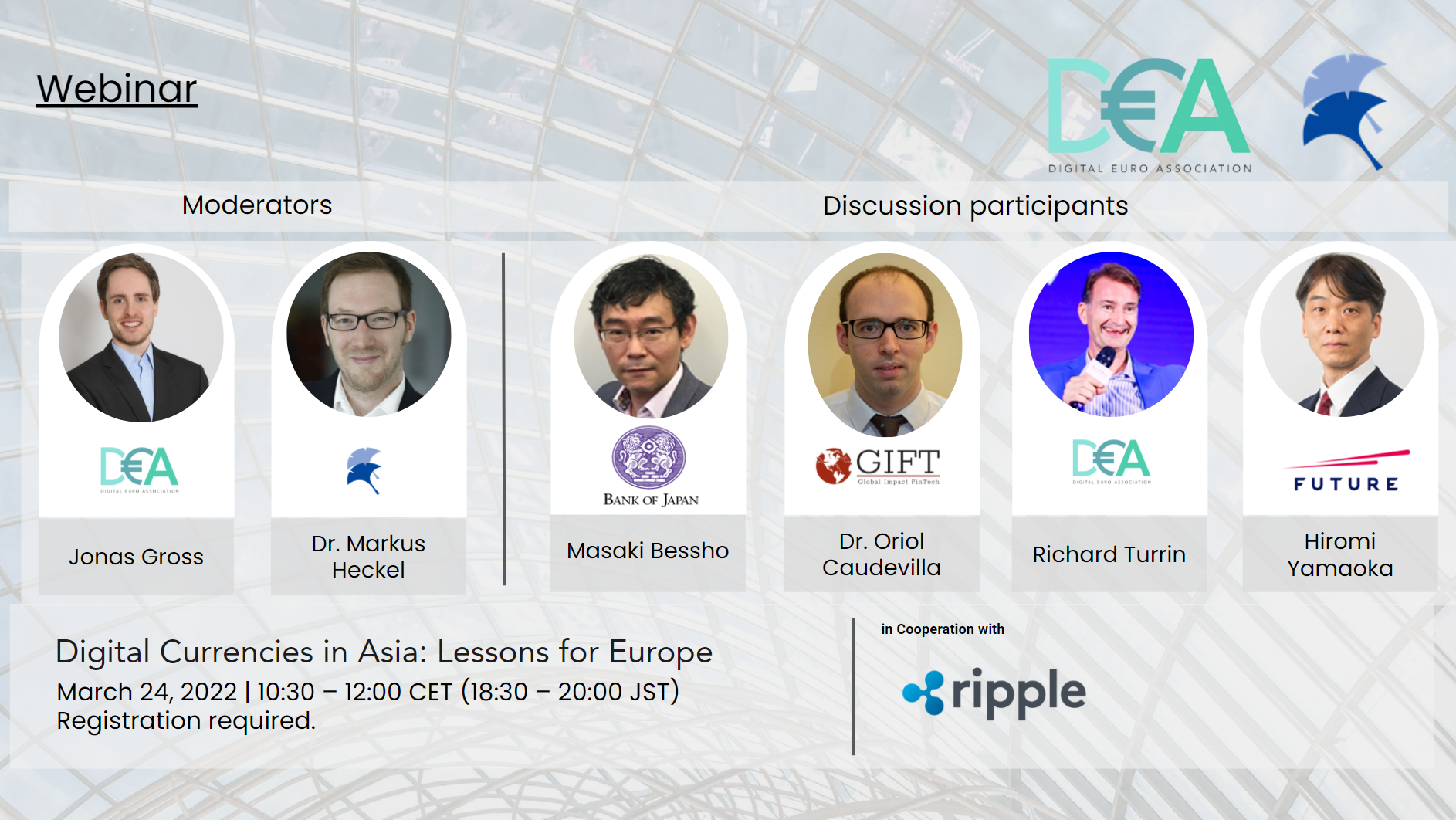

Panel Discussion: "CBDCs in Asia – Lessons for Europe"

by Digital Euro Association on Mar 31, 2022 8:30:00 AM

Central banks around the world have stepped in and intensified their efforts to conceptualize and design their own digital currencies, i.e., central bank digital currencies (CBDCs), in particular, as a reaction to the increased competitive dynamics by the cryptocurrencies and stableco …

Stablecoin regulation in the United States

by Guneet Kaur on Mar 21, 2022 7:45:00 AM

Several regulatory or enforcement measures linked to organizations engaged in stablecoin activities such as issuance, custodial services have been pursued by the US banking agencies, the Securities and Exchange Commission (SEC), US Treasury, and the Commodity Futures Trading Commissio …

The digital euro: let’s move beyond the defensive motivation

by Maria Saenz De Buruaga on Mar 17, 2022 3:00:00 PM

“The euro belongs to Europeans and we are its guardian. We should be prepared to issue a digital euro, should the need arise” (C. Lagarde, European Central Bank)

Digital Euro Association partners with RTGS.global

by Digital Euro Association on Mar 15, 2022 10:15:00 AM

The Digital Euro Association (DEA) is delighted to announce its partnership with RTGS.global, which is building a financial market infrastructure (FMI) for the digital age. RTGS.global makes inter-bank liquidity visible, enabling wholesale cross-border payments to become faster and mo …

Digital Euro Association partners with Circle

by Digital Euro Association on Mar 10, 2022 10:43:17 AM

The Digital Euro Association (DEA) is delighted to announce its partnership with Circle Internet Financial, LLC. Circle is a global internet finance firm that provides payments and financial infrastructure to businesses of all sizes and is the principal issuer of USD Coin (USDC), a do …

It’s time to abandon the “Token vs. Account” discussion

by Ezechiel Copic on Mar 9, 2022 10:15:00 AM

Perusing any whitepaper or report on central bank digital currencies (CBDCs), the reader is almost certain to find a section devoted to the distinction between “token-based” and “account-based” CBDC, where ownership of the former is demonstrated by having knowledge of a private key (o …

Project Hamilton by the Boston Fed: A Summary

by Dr. Franklin Noll on Mar 3, 2022 10:00:00 AM

Introduction Project Hamilton is a joint venture between the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology’s Digital Currency Initiative. It is a multi-year research project aimed at gaining a hands-on understanding of CBDC design. Hamilton is in phase o …

CBDC and the security–financial inclusion dilemma

by David Tercero-Lucas on Mar 1, 2022 10:00:00 AM

In an article entitled “the Restructuring of the UK Financial Services in the 1990s” and published in 1993, two geographers – Leyshon, A. and Thrift, N., coined for the first time in history the term “financial exclusion”. They were worried about the effects of bank branch closures in …