The Digital Euro Conference 2025: A Recap

by Digital Euro Association on Apr 30, 2025 10:19:57 AM

On March 27, 2025, the Digital Euro Conference (DEC25) convened at the Frankfurt School of Finance & Management, bringing together policymakers, financial experts, technologists, and innovators to discuss the future of digital money. Organized by the Digital Euro Association (DEA) …

Looking Ahead: Voices from the Digital Euro Conference 2025

by Digital Euro Association on Apr 29, 2025 7:45:00 AM

As captured by Hetal Patel, a Volunteer at the Digital Euro Conference 2025.

Recap of the DEA Digital Money Networking Event 2024

by Digital Euro Association on Oct 16, 2024 7:45:00 AM

The DEA's third Networking Event, held on October 8, 2024, brought together around 30 participants, including institutional members, dedicated fellows, and esteemed experts. Hosted at the prestigious Frankfurt School of Finance & Management, the event successfully fostered active …

The Digital Euro and Central Bank Digital Currencies: Beware of Taking-Off Too Early

by Prof. Dr. Peter Bofinger on Sep 19, 2024 9:05:25 AM

This paper, by Prof. Dr. Peter Bofinger, discusses central digital currencies (CBDCs) with an analytical focus on the European Central Bank's Digital Euro (D€) project, which provides a unique lens for assessing the potential and challenges of CBDCs. The paper differs from the literat …

Exploring the Future of Digital Currency and AI in London this September

by Digital Euro Association on Jul 15, 2024 2:33:57 PM

Currency Research is set to pave the way with its upcoming series of events during the Payments, Innovation, and Technology Week, taking place from 📅 September 23 to 26, 2024, in the vibrant city of 🏙️ London. This event promises to be a cornerstone for professionals keen on explori …

The Digital Euro Conference 2024: A Recap

by Digital Euro Association on Mar 20, 2024 7:45:00 AM

The Digital Euro Conference (DEC24), conducted on February 29, 2024, assembled a diverse group of experts, policymakers, and industry leaders in a hybrid setting, combining both on-site and remote participation. The engaging event happened in two designated spaces (Audimax and Innovat …

The Journey Towards a Digital Euro: An Update

by Digital Euro Association on Mar 19, 2024 2:31:24 PM

A Response to Evolving Payment Trends The European Central Bank (ECB) has given an update on the digital euro, an initiative set to bridge the gap between traditional cash and the increasing preference for digital transactions. In a recent speech by ECB Executive Board Member, Piero C …

Is Hong Kong really in the forefront of the global digital money race?

by Amnon Samid and Professor Gideon Samid on Dec 12, 2023 12:21:51 PM

Hong Kong has excelled as a world center of finance, trade and professional services. An excellence that was degraded by the brain drain in the years of social unrest, followed by the Covid-19 pandemic and negative perceptions about what Hong Kong has become. Advancements in digitaliz …

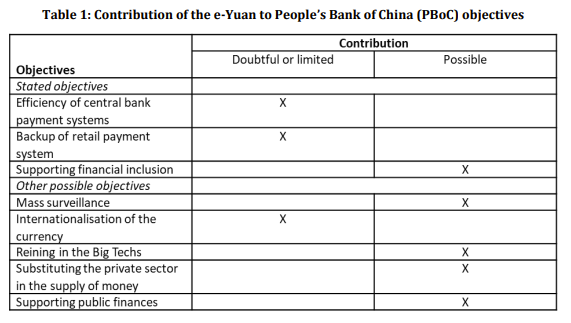

Who Needs an e-Yuan?

by Christian Pfister and Nicolas de Seze on Dec 1, 2023 10:45:55 AM

China could be the first major economy to issue a CBDC. We first provide an historical overview of this project, putting it in political perspective, then present its main features. We recall the strategic objectives put forward by the People’s Bank of China (PBoC) for the e-Yuan, dis …

The Subtle Art of Slow: The CBDC Adoption Journey

by Dr. Jonas Gross and Conrad Kraft on Nov 17, 2023 12:16:01 PM

In the era of rapidly evolving monetary systems, central bank digital currencies (CBDCs) have emerged as a new frontier.